How to Check and Pay ILOE Insurance Fine 2026

Protecting your finances is especially important in times of uncertainty in life. Involuntary loss of employment (ILOE), or Unemployment Insurance is there if you unexpectedly lose your job.

Losing your job can be stressful. In the UAE, the ILOE insurance is designed to help during tough times. However, missing payments or deadlines can lead to hefty fines and even bigger problems. Don’t let financial worries add to your stress.

However, if you fail to meet the deadlines or payments, you must pay fines of Dh200 to Dh400. If not paid, this might lead to more problems like work permit suspension or salary deductions. The Ministry of Human Resources and Emiratisation (MoHRE) requests workers to pay fines immediately. So, understanding how to check and pay ILOE insurance fine 2025 is crucial for every employee.

This guide will help you understand how to ILOE fine check online, and pay them. Let’s make sure you’re protected.

Table of Contents

The UAE’s ILOE Initiative for Employee Protection

Introduced on 1st January 2023, the ILOE scheme safeguards UAE workers with vital social protection against involuntary job loss. Additionally, the objective is to provide financial support to unfairly laid-off workers in circumstances beyond their control.

Workers must contribute to the ILOE insurance fund to be eligible for compensation. The monthly contribution ranges from AED 5 to AED 10, depending on the employee’s salary.

How ILOE Insurance Fine Offers Financial Aid?

After one year of consistent subscription, participants are eligible for compensation equivalent to 60% of their basic salaries for three months. This financial assistance aims to relieve the burden of living while unemployed, offering a level of stability and security.

According to MOHRE statistics, over 6.6 million workers are now enrolled in the ILOE job loss insurance program. Additionally, this extensive participation underscores the scheme’s significance in safeguarding workers’ financial security across various industries.

ILOE Compensation Plan

ILOE insurance plans aim to provide security by catering to various salary brackets, ensuring compensation for unexpected job loss.

Plan For Salaries Below AED 16,000

If your monthly income is below AED 16,000, you fall in the Category A. The contribution for this category amounts to 5 AED + VAT per month, summing up to 63 AED annually. In return, subscribers are eligible for a compensation benefit of up to 10,000 AED per month in the unfortunate event of job loss.

| CATEGORY A |

| Basic Salary 16,000 AED or below |

| 5 AED+VAT/Month |

| Up to 10,000 AED/Month |

| Up to 3 Months / Claim |

Plan For Salaries Above AED 16,000

Employees earning above 16,000 AED, stand in Category B. Here, the monthly contribution is 10 AED + VAT which translates into 120 AED + VAT yearly. This category allows subscribers to access more substantial compensation benefits, reaching up to 20,000 AED per month during the unemployment period.

| CATEGORY B |

| Basic Salary 16,000 AED |

| 10 AED+VAT/Month |

| Up to 20,000 AED/Month |

| Up to 3 Months / Claim |

Also Read:

How to Get an International Driving License in Dubai 2024

Required Documents:

The process of ensuring smooth enrollment and access to ILOE benefits is simple. The necessary documents you need are:

- Emirates ID or Unified Number: Your identification is the gateway to enjoying the safety features provided by ILOE insurance.

- Valid UAE Mobile Number: Stay updated by providing a valid UAE mobile number to receive appropriate and timely messages.

Who Isn’t Covered by the UAE Unemployment Insurance (ILOE)?

Not everyone can get money when they lose their job in the UAE. Some people don’t have to pay for unemployment insurance and won’t get money if they lose their jobs.

- Bosses and Owners: People who own a company or part of a company.

- Helpers at Home: People who work as maids or cleaners in homes.

- Temporary Workers: People with jobs that only last for a short time.

- Young Workers: People who are younger than 18 years old.

- People with Pensions: People who get money after they stop working.

How to Pay ILOE Fine 2025?

Suppose you’re a member of the ILOE scheme and need to check and settle fines efficiently. In that case, the ILOE Quick Pay Fine feature on the Ministry of Human Resources and Emiratisation (MOHRE) app or website is here to simplify the process. Follow these simple steps to check and pay ILOE unemployment insurance UAE fine seamlessly.

Step 1: Download the MOHRE App and Sign-in with UAE Pass

First, download the MOHRE app available for both Apple and Android devices. After installation, log in using your UAE Pass – the national digital identity of UAE citizens, visitors, and residents.

Now, choose the ‘employee’ option and enter your labor card number. If you don’t know your labor card number, the app provides a convenient way to retrieve it.

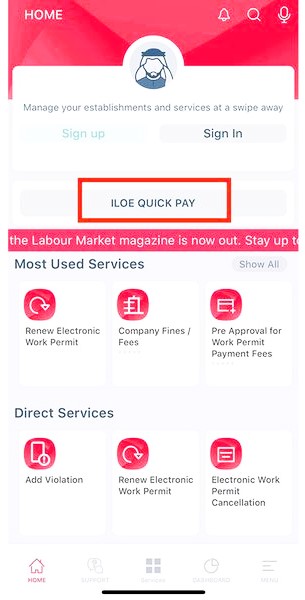

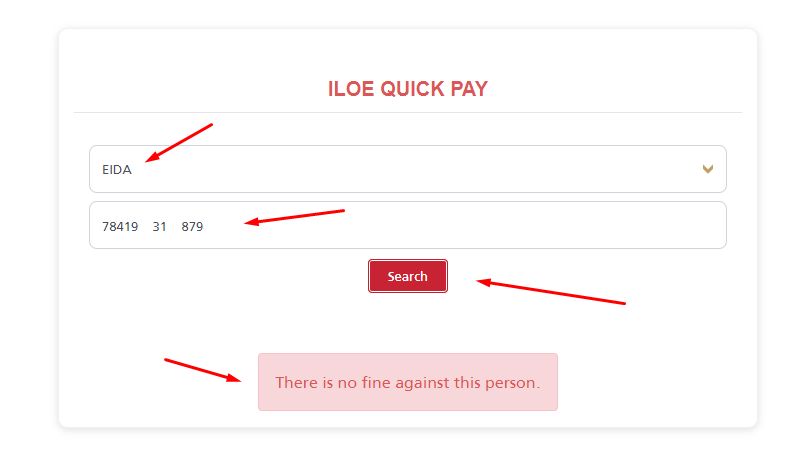

Step 2: Get the ‘ILOE Quick Pay’ Service

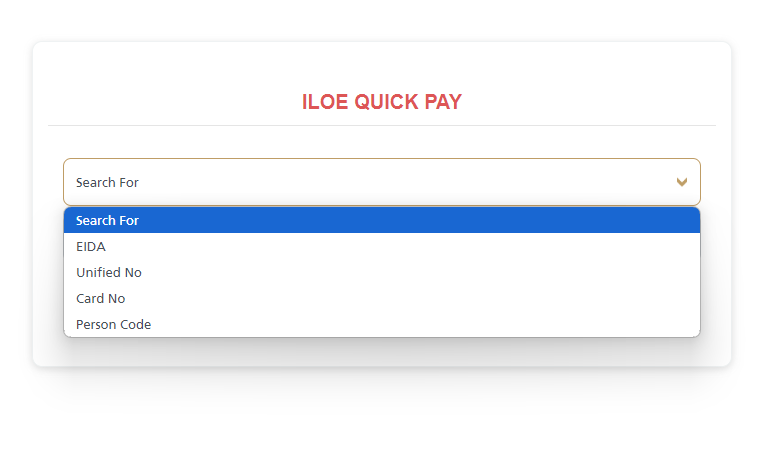

- Go to the app’s home page and tap on the “ILOE Quick Pay” service. A menu will appear, and choose one of the following options:

- Emirates ID number

- Unified Number (UID No.)

- Labor card number

- Personal code number (a 14-digit number on your labor card)

- Provide the relevant information according to your chosen option and click ‘Search.’

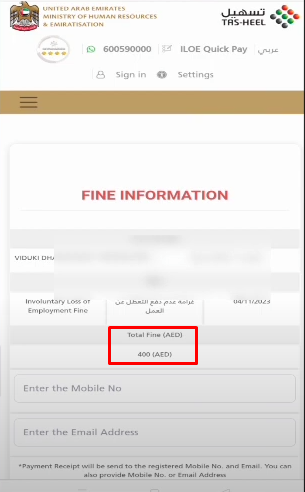

Step 3: Check and Pay Your ILOE Fines

Subscribers with timely payments receive a clean record pop-up. However, if fines exist, pay online with a credit or debit card or in installments.

After the payment is made, MOHRE takes less than one working day to process it, ensuring a swift resolution to your outstanding fines.

Check Your ILOE Fines On App

Assessing the fines has never been so simple as with the MOHRE UAE mobile app.

- Sign-in or Login with UAE Pass: Install the MOHRE UAE mobile app on your smartphone. Once installed, sign in or log in using your UAE Pass credentials for secure access.

- Navigate to ILOE Quick Pay: Navigate to the app and find the ILOE Quick Pay option located on the home screen. Tap on the icon to proceed.

- Enter Card Number or Person Code: Type your card number or case code that is linked to your ILOE insurance in the field. This step ensures that the system retrieves the relevant information accurately.

- Click Search and Check Fines: Now, click on the search icon to initiate the process. The app will display fines linked to your ILOE status, providing you with clarity and peace of mind.

What are the other ways to pay ILOE Fines?

In addition to traditional subscription methods for ILOE insurance, various alternative channels accommodate diverse preferences and accessibility. These include:

- Etisalat Botim: Etisalat’s Botim service allows subscribing to ILOE insurance, making it convenient for their customers.

- Dubai Islamic Bank and Mashreq Bank: Dubai Islamic Bank and Mashreq Bank support ILOE subscriptions, complementing their banking services with insurance provisions.

- Al Ansari Exchange: Al Ansari Exchange acts as another channel for ILOE subscriptions, presenting a dependable alternative to people who desire insurance coverage.

- MOHRE TASHEEL and TAWJEEH Centers: Managed by the Ministry of Human Resources and Emiratisation (MOHRE), TASHEEL and TAWJEEH centers offer personal assistance for ILOE subscription to individuals who prefer in-person registration.

- Upay and MBME Pay Kiosk: Additionally, Upay and MBME Pay Kiosk provide self-service kiosks for the acquisition of ILOE subscriptions. Here, people can conveniently subscribe to insurance coverage on their own time.

- C3 Pay: Moreover, C3 Pay serves as another electronic payment platform for subscribing to ILOE insurance. It joins the long list of digital options available for users.

Conclusion

All in all, prioritizing your financial stability is crucial in uncertain times. Fortunately, the Involuntary Loss of Employment (ILOE) scheme offers a comprehensive solution to safeguard your finances.

However, the Ministry of Human Resources and Emiratisation (MOHRE) has simplified processes for verifying, compensating, and receiving benefits, ensuring a smooth and efficient experience. Embrace the benefits of ILOE to confidently navigate unexpected job loss and safeguard your financial well-being.

Also Read:

7 Essential RTA Fines Every Dubai Driver Should Know